The Kmart Anko Partnership: A Retail Narrative

In the competitive landscape of global retail, few stories are as transformative—or as unlikely—as the rise of Anko. The Kmart Anko partnership is certainly not what it seemed at first.

What began as a desperate survival strategy for a struggling Australian department store has evolved into a multi-billion-dollar private-label juggernaut. Today, Anko isn’t just a brand found in Kmart; it is a global sourcing powerhouse that has redefined “cheap” as “chic,” conquered international markets, and effectively swallowed its former rival, Target Australia.

The Resurrection: From “Daggy” to Dominant

To understand Anko, one must understand the “Kmart Miracle.” In 2008, Kmart Australia (wholly owned by Wesfarmers and distinct from the American chain) was the “sick man” of Australian retail. It was cluttered, overpriced, and losing relevance to fast-fashion and online giants.

The turning point arrived with former McDonald’s executive Guy Russo, who took the helm with a radical “Volume-Value” strategy. Russo’s mantra was simple: strip away the complexity. He slashed the number of products (SKUs), removed high-end national brands, and pivoted toward a vertically integrated model where Kmart would design, source, and brand its own goods.

“A New Kind Of”: The Birth of a Brand

For years, Kmart’s home brands were fragmented under names like Home&Co, Kids&Co, and Active&Co. While effective, the branding lacked a cohesive identity. In 2018, Kmart made the bold move to consolidate almost all of its private-label categories under a single banner: Anko.

The name itself is a clever play on the internal shorthand “&Co”, but it was officially marketed as an acronym for “A New Kind Of.”

Rumours that Anko was a South Korean mega-manufacturer proved to be unfounded. Despite its modern, minimalist branding that often evokes the sleek “K-beauty” or “K-lifestyle” aesthetic, based on the flagship “K-pop” and “K-drama” cultural flagships, Anko is not a South Korean brand. It is a homegrown Australian retail success story.

By moving to a single brand, Kmart achieved massive economies of scale. Instead of negotiating with dozens of external suppliers for toothbrushes, towels, and t-shirts, they became the manufacturer. Today, Anko represents over 85% of everything sold in Kmart stores. This vertical integration allows the retailer to maintain “Everyday Low Prices” while controlling the aesthetic—a minimalist, on-trend look that belies its budget price tag.

The Cult of the “Kmart Hack”

Anko’s success wasn’t just built on spreadsheets; it was built on TikTok and Instagram. The brand’s design team mastered the art of “duping”—identifying high-end interior design trends and replicating them for a fraction of the cost.

This sparked the “Kmart Hack” phenomenon, where a $10 Anko side table or a $20 storage unit would go viral, with influencers showing followers how to style or DIY them into luxury-looking home additions. Anko became more than a brand; it became a lifestyle.

Best-Selling Product Successes

Several Anko products have achieved legendary status in Australian retail history, often selling out within hours of hitting the shelves:

The $99 Spot Cleaner: A portable upholstery cleaner that went viral on TikTok. It performed similarly to premium models costing $300+, leading to months of backorders.

The Scandi Shoe Rack: This $25 bamboo and fabric unit became the face of the “Kmart home” aesthetic. It was so popular it spawned a dedicated subculture of interior design enthusiasts.

Insulated Drink Bottles: While the world obsessed over $50+ Stanley cups, Anko’s $10–$15 “Double Wall” versions offered near-identical performance, selling in the millions.

The “Anko Body Butter”: Part of their beauty expansion, this product was hailed as a “dupe” for luxury Brazilian creams, causing a frenzy in the beauty community.

The Strategic Pivot: The Target Merger

The most significant chapter in the Anko story began in 2023–2024. As Kmart’s profits soared, its sister store, Target Australia, struggled. Wesfarmers made the executive decision to merge the back-end operations of the two giants into the Kmart Group.

In a move that initially shocked “Target loyalists,” Wesfarmers began stocking Anko products on Target shelves. This move effectively turned Target into a “Kmart-lite” for general merchandise, allowing the group to leverage Anko’s massive sourcing power across 450+ stores. While Target maintains its own branding in apparel, the “Anko-fication” of its home and toy sections has been a cornerstone of the group’s record-breaking $1.1 billion annual earnings.

Anko Global: Exporting the Model

Anko is no longer just for Australians. Under the Anko Global banner, Wesfarmers is now selling the brand to the world.

The Philippines: Anko has opened large-scale standalone stores in major malls like Trinoma and Glorietta, using brand ambassadors like Anne Curtis to position itself as a premium yet affordable lifestyle choice.

India and Canada: Through partnerships with local retailers and online platforms, Anko is testing the waters in massive markets, proving that “Australian design, global sourcing” has universal appeal.

The US Experiment: While a brief brick-and-mortar trial in Washington state was shuttered during the pandemic, the brand continues to explore digital avenues to reach the North American market.

A Retail Revolution

The Kmart-Anko partnership is a masterclass in modern retail. By transforming from a middleman into a product maker, Kmart has insulated itself from the “death of the department store.”

Anko has proven that price is no longer a barrier to style. In an era of high inflation and cost-of-living pressures, the brand has become the “great equaliser,” attracting everyone from budget-conscious students to high-income earners looking for a $5 kitchen gadget.

As Anko continues its march across Southeast Asia and into the hearts of Target shoppers, it remains the “secret sauce” of Australian retail—a brand that didn’t just survive the retail apocalypse, but thrived because of it.

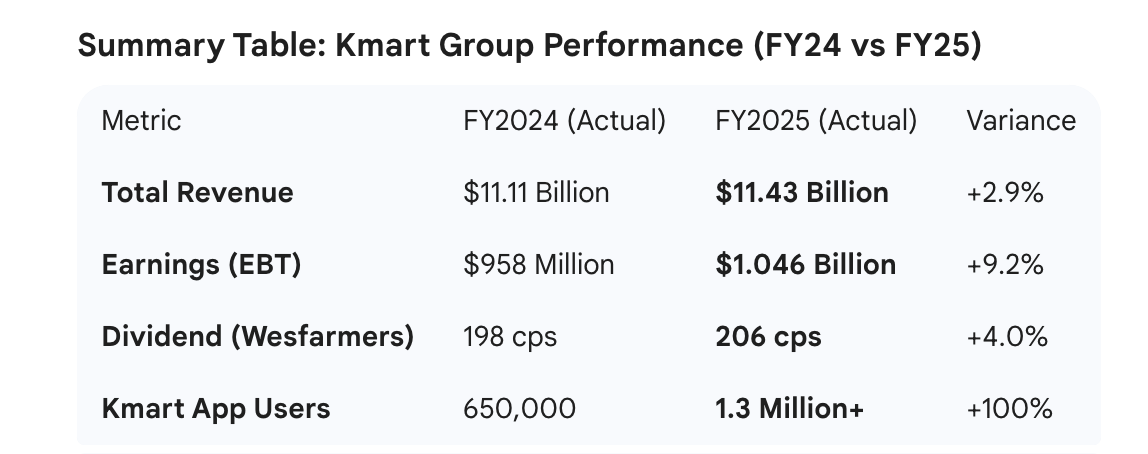

Based on the most recent financial reports from Wesfarmers Limited, the impact of the Anko brand and the subsequent Kmart-Target merger has been nothing short of transformative. As of late 2025, the “Kmart Group” (comprising Kmart and Target) has emerged as one of the most profitable engines in the Wesfarmers portfolio.

Below is a financial analysis of how the Anko-centric strategy has impacted the bottom line.

1. The Billion-Dollar Milestone

In the 2024/25 Full-Year Results (released August 2025), the Kmart Group reached a historic peak. For the first time, its earnings before tax (EBT) surpassed the $1 billion mark, landing at $1.046 billion.

Revenue Growth: Total revenue for the group hit $11.4 billion, a 2.9% increase from the previous year.

Profitability: While revenue growth was modest, earnings grew by 9.2%, signaling that the group is becoming significantly more efficient at squeezing profit out of every dollar spent.

2. The “Anko-fication” of Target

The merger of Kmart and Target’s back-end operations (which began in late 2023) has been

the primary driver of this profit surge. By replacing Target’s independent sourcing with the Anko supply chain, Wesfarmers achieved two major goals:

Productivity Gains: The group reported that integrating systems and processes helped “fractionalise” costs. Essentially, they are now running two massive retail chains with the overhead and supply chain of one.

Margin Expansion: Because Anko is a private label (meaning Kmart/Target own the brand and the design), they do not have to share profits with external suppliers. Anko now accounts for approximately 85% of Kmart’s sales, a model that is being rapidly replicated at Target.

3. Return on Capital (ROC)

One of the most impressive metrics in the latest report is the Return on Capital (ROC) for the Kmart Group, which reached a staggering 65.9% in the first half of FY25.

This means that for every dollar Wesfarmers invests in the Kmart Group’s assets (stores, inventory, tech), they are generating nearly 66 cents in profit. This is vastly higher than traditional department stores, which typically struggle to reach double-digit ROC.

4, The Attraction of Young “Funky” Staff

Kmart used to be known as the store that attracted “the staff that Bunnings rejects”, a play on the famous advertising catch-cry from premillennial television: “the fish John West rejects”. Kmart still has the glary, harsh fluorescent lighting but where once its stores had a dead energy feel, now stores are often abuzz with a new generation of eager shoppers loving the vibe of Anko and Kmart’s trendification.

The Kmart Anko partnership is an immediate embodiment of NIKE’s “just do it” philosophy – the trendy transformation happened on the ground / shop floor, and then filtered into Australia’s national psyche from the ground up, relying on growing shopper awareness and appreciation triggering word of mouth. Therefore Kmart has seemingly no need for digital marketing or SEO and once shoppers are hooked on the variety and qualities of the Anko brand, even television and radio advertising is becoming peripheral to the Kmart-Anko retail juggernaut.

With this buzzification of Kmart’s corpse-like floor, Kmart’s human resources have started to attract the polar opposite of its previous embarrassment – now Kmart attracts “the staff that reject Bunnings”. Good-looking, and more importanly intelligent-looking staff roam the store, with the kind-of quizzical intellectual gaze that can be intimidating to a shopper with slightly lowered self–esteem – asking dumb questions like where’s girls socks are, or the linen sheets, may draw from these staff a bemused eyebrow wondering how any shopper can still be so non-savvy, so lacking in savviness but just when a clueless consumer might think their chosen quizzee shall say to them (2024 & previously) “just google (verb) it”, or 2025 & beyond’s version “just chatgpt (verb) it”, it turns out Kmart’s staff are so well trained, so humanistic, if there’s a product you’re seeking that’s out of stock, they will check their smartphones, if their phones are showing they have the product out the back they’ll politely ask you to bear with them a few moments whereupon they will dart out the back into the Kmart warehouse to bring it to you.

Or if not in their store, they’ll let you know how many of the product are available in other Kmart stores in your city. They’re suave, they’re cool, they could likely tiptoe like Fred Astaire or sing you the answer like Katie Perry or Taylor Swift, but they’re making each shopper feel like Kmart is now the place to be.

Anko National Anthem

Australians all let us rejoice

Kmart’s the place to be

We’ve Anko brands now in our hands

Girt by commerciality

Our store abounds with factory gifts

Beauties for rich and poor

On retail’s page let every stage

(Advance) Anko forever more

In consumeristic strains now let us bling

Anko on Kmart’s floor.

Beneath our radiant fluorescent lights

We’ll shop with eyes and ears

To make this Kmart wealth of ours

Resound with shopper cheers

Products we’ve sourced across the seas

We’ve boundless isles to share

With courage let us all consume

The Anko-Kmart fare

In cashless strains now let us bling

Advance Kmart’s Anko wares.

5. Anko Global: The New Growth Frontier

While still in its early stages, Anko Global (the international expansion) is now a core pillar of Wesfarmers’ long-term strategy.

Philippines Expansion: Following a successful pilot, Wesfarmers has opened multiple standalone Anko stores in the Philippines (e.g., Glorietta and Trinoma).

International Partnerships: Anko products are now being distributed through major global retailers in India, Canada, and the UK, effectively turning Kmart from a local shopkeeper into a global wholesaler.

Status: As of the late 2025 reports, Anko Global’s revenue is still described as “immaterial” compared to the Australian core, but it is being positioned as the primary growth engine for the next five years.

Anko’s South Korea Twist: The “Design Charisma” Strategy

Anko’s success relies on “Design Charisma”—the ability to make a $10 item look like a $100 one. By sourcing from South Korea, Anko can access the same production lines used by global luxury brands. This allows them to replicate high-end finishes, such as the matte texture of a “soft-touch” water bottle or the specific weave of a microfibre towel, at a fraction of the price.

In summary, while Anko is proudly Australian, its “secret sauce” is its ability to cherry-pick the best manufacturing strengths from around the world. South Korea serves as the brand’s “innovation lab,” providing the technical edge that keeps Anko products appearing on “best of” lists and viral social media feeds worldwide.

Kmart Customers’ Reviews: An Improving Voice

“I used to hate going to Kmart so much … it was a “living death” to me. But now I’m begrudgingly starting to rely on regular Kmart visits. They’ve significantly improved the quality of their products, still a long way to go with a lot of things, but there’s a lot more of the cheap stuff where we might exclaim “that’ll do”, while impressing with better designs and pretty much everything in the store is Anko brand.”

Hope is now the Kmart-Anko currency – shoppers wander the store hoping to find exactly what we think we want, and increasingly we find something even better.

That this megalithic retail romance was nurtured in Westfield to now become a match made in commercial rental heaven is just part of the story, because Target has now joined the union – if you can’r beat them, join them, Target has turned a potential threesome into a monopolistic throuple. Australian shoppers continue to want more than a monopoly, yet everywhere we look, we see duopoly as most of the option – Coles and Woolworths with a little bit of Aldi and IGA, Kmart and Target with a little bit of Big W, and Labor and Liberal with a little bit of National, One Nation and the Greens. We’re still a pre-adolescent society based in the duopolistic model of Ma and Pa with a little bit of stepmum and stepdad, he and she with a little bit of they and them.

In the meantime, Kmart used to be such a daggy monolithic retailer, but since their massive success with the Anko brand, for a swathe of the Australian population, it has become “the place to be”.

Related Posts

Categories

- Animals (1)

- Artificial intelligence (AI) (9)

- Blog (70)

- Client Links (11)

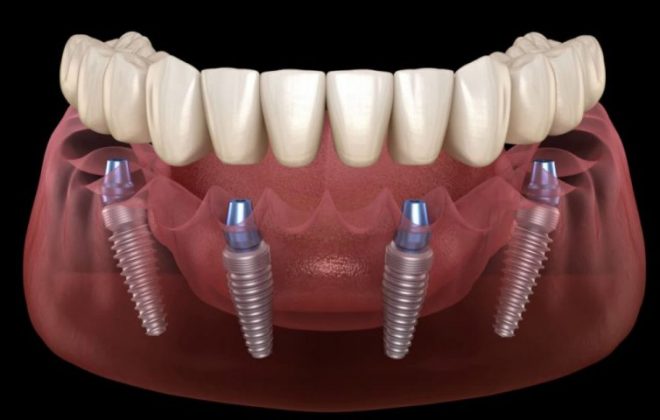

- Dental Marketing (1)

- Design (5)

- Digital Marketing (58)

- Film (1)

- Media (8)

- Music (1)

- News (26)

- Retail Marketing (1)

- SEO Case Studies (15)

- SEO Company Sydney (10)

- SEO Posts (27)

- SEO Sydney (29)

- SEO Testimonials (5)

- Shopping (1)

- Social Media Australia (11)

- Social Media Management (11)

- Social Media Managers (2)

- Social Media Sydney (10)

- Social Media Training (2)

- Travel (4)

- Uncategorized (3)